Together, these factors generate a self-reinforcing cycle of debt saturation, declining collateral and credit contraction.

If we want to understand where the economy is going, credit and risk are good places to start. Credit/debt is how the system creates and distributes money: when a home buyer gets a mortgage to buy a house, that mortgage increases the money supply. When the mortgage is paid off, the money supply contracts.

The mortgage is secured by two things: the income of the buyer and the house, which is the collateral for the loan.

Risk is integral to credit. Should the income of the buyer or the value of the house decline sharply, the loan is at risk of default / loss. In the national/global economy, the cost of credit reflects trends and policies that raise or lower the risks which then influence the cost of credit: as risk rises, the cost of credit goes up.

As macro-risks rise, the cost of credit pushes mortgage rates higher, increasing the percentage of income the buyer must devote to service the mortgage. This leaves less income for additional debt or consumption.

Once their income is maxed out, the buyer reaches debt saturation: there is no more spare income to service additional debt. The workaround to debt saturation is to engineer lower interest rates, so the buyer can refinance debt at lower interest rates and reduce the monthly cost, freeing up more income for additional debt/consumption.

But when systemic risks rise, lowering interest rates is no longer possible. Rates rise to reflect the risk premium generated by uncertainty and the higher potential of defaults and losses.

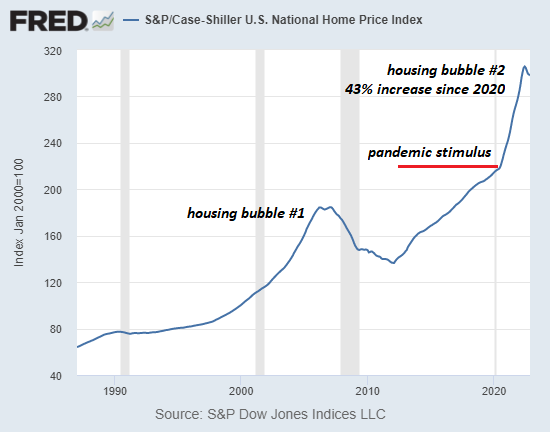

Expanding credit is the lifeblood not just of consumption but of asset valuations. Home prices rise when the pool of buyers with sufficient income and creditworthiness to buy a house is larger than the inventory of available homes. When interest rates plummeted in the pandemic stimulus phase, house prices soared as buyers panic-bid for properties.

(The same mechanism supports stocks, as corporations borrow money and use it to buy back their own shares, boosting per-share valuations.)

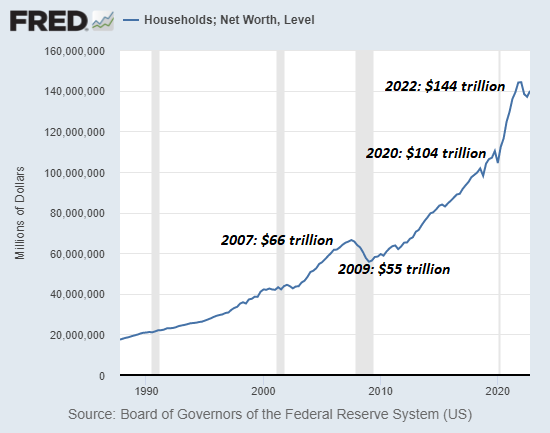

Declining interest rates and rising asset valuations create a virtuous cycle in which higher asset prices provide more collateral to support bigger loans, loans which are easier to service as interest rates drop.

This self-reinforcing feedback of higher asset prices / increased collateral enabling more debt is clearly visible in the charts below of the Case-Shiller national Home price Index, which soared 43% in the two years from 2020 to mid-2022, and the Households Net Worth which increased by a staggering $44 trillion in the two years following the pandemic stimulus.

The risk profile of credit has changed both nationally and globally, and cost of credit cannot fall back to near-zero.

I addressed this in

Why Interest Rates Are Not Going Back to Zero.

At the same time, productivity and wages have stagnated, leaving less income to service additional debt.

As I explained in

Here’s How We’ll Have Labor Shortages and High Unemployment at the Same Time, workers with skills that are scarce and in demand will command higher wages, while those with skills that are not in demand will not be able to find work or maintain high earned incomes.

As risk and the cost of credit rise, the valuations of assets dependent on expanding credit decline. Not only do owners of assets such as houses feel less wealthy–the reverse wealth effect–the collateral available to secure additional credit drops.

Together, these factors generate a self-reinforcing cycle of debt saturation, declining collateral and credit contraction: risk rises, credit costs rise, incomes and collateral decline and all the consumption and asset valuations that are dependent on credit expansion go over the falls.

Gordon Long and I discuss these dynamics in our latest video

Its a Waterfall – Risk, Collateral & Productivity. (48 min, numerous charts)

New Podcast:

Turmoil Ahead As We Enter The New Era Of ‘Scarcity’ (53 min)

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

| Thank you, Stephen H. ($100), for your outrageously generous contribution to this site — I am greatly honored by your support and readership. |

Thank you, Nicola L. (5.50 euros/month), for your monstrously generous pledge to this site — I am greatly honored by your support and readership. |

| Thank you, Scott B. ($5/month), for your magnificently generous pledge to this site — I am greatly honored by your steadfast support and readership. |

Thank you, Troy Z. ($25), for your much-appreciated generous contribution to this site — I am greatly honored by your support and readership. |