Absent demand from tens of millions of wealthy, high-income buyers, asset valuations will fall as Boomers sell off assets to fund their retirement.

There’s a peculiarly flawed logic behind the widely held view that the Baby Boomers will seamlessly transfer tens of trillions of dollars of their wealth to the Gen-X and Millennial generations as they exit stage left. This is flawed for a very basic reason: the extremely overvalued assets that will be transferred–real estate and stocks–only reached such extreme overvaluation because there is a surplus of buyers who are sufficiently wealthy (and willing) to pay bubble-inflated prices.

Since the ownership of both real estate and stocks is concentrated in the hands of the wealthiest 10% who tend to be older, how many Gen-Xers and Millennials have the means to buy million-dollar bungalows and overpriced portfolios? If buyers are scarce due to entrenched wealth-income inequality, then once Boomers start selling their vast holdings of stocks and millions of overpriced homes, prices will plummet if sellers outnumber qualified and willing buyers.

In other words, the bloated valuations Millennials hope to inherit will only remain at the currently overvalued levels if millions of qualified buyers emerge to snap up every Boomer bungalow at today’s bubble prices. If there are fewer buyers than sellers, prices will decline accordingly.

Younger generations hoping to inherit million-dollar McMansions and stock portfolios overlook that many aging Boomers are planning to sell their stocks and homes to fund their retirement. Boomers who are wealthy on paper are wealthy due to their ownership of stocks and real estate; they need to liquidate these assets to afford to retire at their desired level of comfort.

Another overlooked factor is inheritances often require selling the house to split the money between heirs. Once again, the inheritance depends on buyers emerging like locusts to buy up every house being sold at absurdly overvalued prices. How many younger people will have the means or willingness to buy the millions of overpriced bungalows being dumped on the market?

Hopeful heirs also overlook that prices are set on the margin. Take a neighborhood of 100 homes. If every home that sells fetches fewer dollars, the sale of only 10 homes can cut the valuations of the other 90 houses in half in a few years.

People are living longer nowadays, and since few retirement / nursing homes are being built, many Boomers will have to stay in their own home as they grow old. Assisted living / nursing home fees run around $10,000 to $12,000 or more a month; private nursing care in residential homes typically runs between $6,000 to $9,000 a month. Few can afford these options unless they sell their house. It’s far more affordable to continue living at home until the end of one’s life.

That can either consume the inheritance or extend the transfer of assets to the point the heirs are in their 70s. For example, my Mom is 95 years old, bless her heart, and she sold her house 17 years ago to fund her retirement in an assisted living complex. Her house proceeds funded her retirement years; there will be little left (if any) for her heirs.

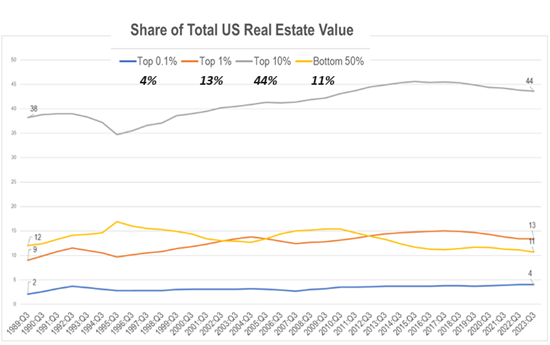

If we consider the vast concentration of wealth in the top 10% (typically the wealthiest Boomers), it’s clear there aren’t enough young people who can afford to buy assets at today’s valuations to keep the prices at nosebleed levels. As this chart shows, the top 10% own 44% of all real estate in the US, while the bottom 50% of households own a meager 11%.

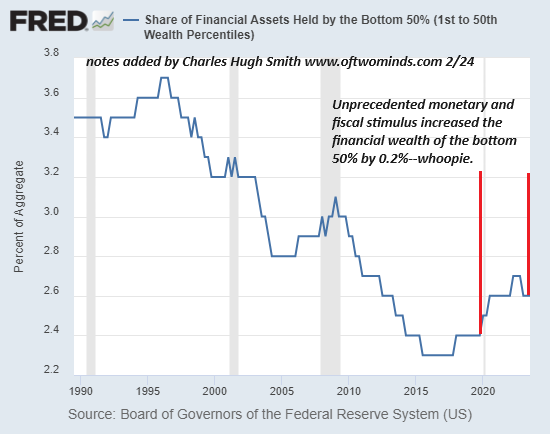

That’s much more than their share of the nation’s financial wealth, which is a rounding-error 2.6%:

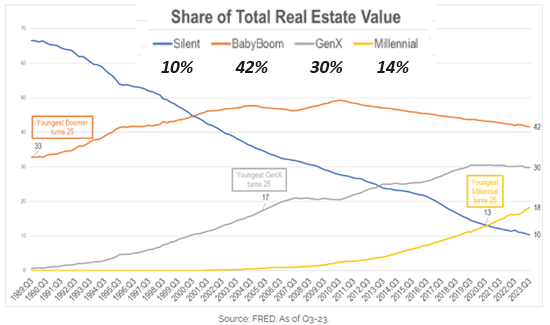

Boomers own 42% of all real estate value, with Gen-Xers holding 30% and Millennials owning 14%. We can surmise that the majority of Gen-Xers who can afford to buy a home have already done so. Given their relatively modest numbers and age, counting on Gen-Xers to soak up millions of Boomer Bungalows for $1 million does not reflect generational / financial realities.

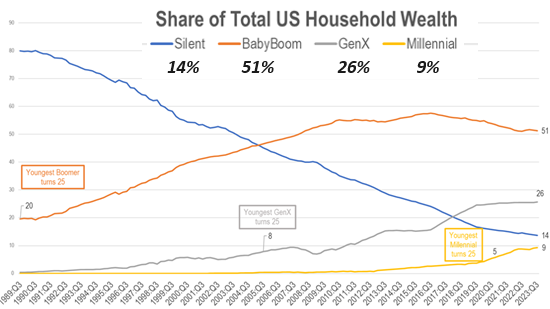

That leaves the buying of millions of Boomer Bungalows for $1 million each to Millennials, who have the numbers but not the wealth to do so. Boomers hold 51% of household wealth, while Millennials hold a mere 9%.

So the expectation that nosebleed valuations for houses and stocks will remain at a “permanently high plateau” is based on flawed reasoning that Millennials will be buying millions of homes being dumped by Boomers to fund their retirement at today’s prices, and this buying by Millennials will maintain the high valuations of homes and stocks they will eventually inherit–possibly far later in their own lives than they anticipate.

This doesn’t add up. The concentration of wealth in the top 10% and the Boomer generation means there cannot possibly be enough buyers in the ranks of those with few assets, high debt loads and modest incomes with sufficient wealth and income to buy Boomer assets at today’s bubble prices.

Since the top tier of older, wealthier folks own 50% of all wealth, there is no way those with lesser means can afford to buy all those assets at today’s bubblicious valuations. It simply doesn’t compute.

Absent demand from tens of millions of wealthy, high-income buyers, asset valuations will fall as Boomers sell assets to fund their retirement. In many cases, the wealth younger people hope to inherit will be consumed by costly nursing home fees.

This is the price of enabling a concentration of wealth in the hands of the top 10% and the older generations who bought assets at pre-bubble prices and have enjoyed the appreciation created by stupendous bubbles.

But those valuations will only be reaped by the first sellers. Everyone selling as demand falters due to insufficient numbers of buyers who can afford to pay today’s prices will find valuations will fall once selling overwhelms demand.

The expectation that tens of trillions of dollars in assets whose value is set on the margins will magically retain their bubble valuations as aging Boomers liquidate their assets en masse in an economy where only 20% of the populace can afford to buy a house at today’s prices is not grounded in demographic or financial realities.

New podcast: Financial Nihilism, Inflation & The Collapsing American Dream.

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18,

(Kindle $8.95,

audiobook $13.08 (96 pages, 2022)

Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

| Thank you, Spieper61 ($70), for your monumentally generous subscription to this site — I am greatly honored by your support and readership. |

Thank you, Blaine ($7/month), for your exceedingly generous subscription to this site — I am greatly honored by your support and readership. |

| Thank you, Mimi A. ($7/month), for your magnificently generous subscription to this site — I am greatly honored by your support and readership. |

Thank you, Anders L. ($7.42/month), for your superbly generous subscription to this site — I am greatly honored by your support and readership. |