The self-sustaining recovery is a fantasy that's evaporated.

What looks like a powerful, can't-lose rally to newbies is recognized as distribution by old hands. In low-volume markets (as in the past few months), insiders holding large positions can't dump all their shares at once or the price of the stock would plummet due to the thinness of the bid.

The only way to get top-dollar for one's overvalued shares is to play distribution games: sell a little each day on the upticks, and buy back shares when they threaten to drop below the key support levels followed by trading algos.

When insiders have finished distributing their shares to naive and trusting bagholders at the top, then the price can flush lower with a velocity that shocks the complacent bagholders who saw only the inevitability of an endless rally rather than the inevitability of a collapse of bubble valuations.

Stocks are priced for a V-shaped recovery and/or $1 trillion in federal giveaways per month. Neither is possible. The V-shaped recovery hopes were based on $6 trillion in federal/Federal Reserve stimulus washing over the nation, boosting household incomes and opening spigots of cash for enterprises and local governments.

The basic idea was to give the economy a needed shot of adrenaline to get to to the point where a recovery would be self-sustaining: companies would hire back laid-off workers, people would start borrowing and over-consuming again, sales and income tax revenues would return to pre-pandemic levels, etc.

The self-sustaining recovery is a fantasy that's evaporated. The spike in activity was all the giveaways being spent. Now that most of the free-money programs are expiring, there's no more stimulus to spend.

As for budgeting another trillion or two for future infrastructure projects: what few proponents of infrastructure spending realize is the number of companies and skilled workers capable of getting this work done is limited. You can create the cash out of thin air but you can't conjure up experienced welders, crane operators, etc. to get the work done or the complex operational skills required to manage these large, complicated projects.

Also overlooked is the fact that most of these companies and workers are already busy, and it takes years to train new workers with the requisite skills.

So what's left to support the can't-lose rally? The promise of trillions of dollars more given directly to households and enterprises and local governments, at a run-rate of a trillion a month. Anything less won't be enough.

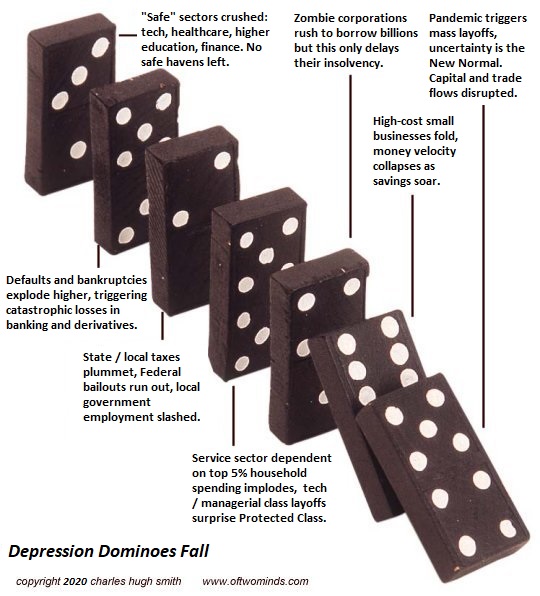

And then there's the line of dominoes that are toppling:

Distribution isn't a rally.

Recent Podcasts:

AxisOfEasy Salon #14: Jobageddon and the Coming Education Revolts

Charles Hugh Smith on the disconnect between the Markets and the Economy (51 min)

My COVID-19 Pandemic Posts

My recent books:

Audiobook edition now available:

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Kevin S. ($50), for your outrageously generous contribution to this site -- I am greatly honored by your support and readership. | Thank you, Michael R. ($5), for your most generous contribution to this site -- I am greatly honored by your support and readership. |