No one is going to finger extreme wealth inequality as the proximate cause of what’s going down in the next decade, but that doesn’t mean it isn’t the tectonic cause.

Ah, yes, the elephant in the room, a problem that’s 1) big and obvious and 2) can’t be solved with the usual painless policy tweaks, so we act as if it’s not there. Denial and delusion are the preferred “solution” because they work just fine until the elephant starts rampaging, at which point we blubber “no one could see it coming.”

Yes, the elephant in the room, what everyone should be focusing on instead of ignoring it. In the current zeitgeist, the room is so jam-packed with elephants, there’s hardly any room left for those ignoring the elephantine crush.

For the elephant in the room is also shorthand for YICBIC (pronounced Yick-Bik): yes it’s clickbait, but it’s important clickbait, so click here and I’ll enlighten you about the really really big problem no one else dares address, the problem that’s going to disrupt all our nice little plans to continue getting richer everyday, in every way.

So shift your gaze from the herd of elephants in the room to the other elephant, the one that’s truly ignored: extreme wealth inequality. This elephant gets an occasional pat on the rear end, more or less equal to the heartbreak of psoriasis or the odds of a Carrington Event frying every digital device on the planet.

So what if wealth inequality now exceeds the peak of 1928-29, just before that decade-long spot of bother, The Great Depression?. That was mere coincidence. The cause wasn’t extreme wealth inequality, it was a Fed policy error, blah blah blah.

The reason why it’s so easy to ignore extreme wealth inequality (EWI) is that we don’t experience EWI as a thing, we experience a decline in our standard of living as wealth is siphoned up into the top 10%.

We sense we’re falling behind, that our situation is increasingly precarious, and the source of this decline seems to be inflation–a decline in the purchasing power of our earnings as prices soar–and global competition from low-cost labor.

Yes, these are factors, but the real driver of extreme wealth inequality is hard to pin down because it works its magic behind the difficult-to-understand convolutions of finance: financialization, which has morphed in the past 15 years into a supercharged hyper-financialization in which capital has risen to dominate the entire economy and the cultural zeitgeist. Everything is now subservient to capital increasing its dominance.

We all understand inflation, soaring prices and rising asset valuations, but understanding the financial plumbing that generates these consequences is difficult, and it’s made more difficult by purposefully misleading fictions designed to obscure, mis-direct or explain away the actual mechanisms of financialization.

For example, the Social Security Trust Fund, a fictitious facade designed to obscure the reality that Social Security and Medicare/Medicaid are pay-as-you-go programs, funded by tax revenues and borrowed money (i.e. federal deficit spending).

If we ask cui bono, to whose benefit?, the answer is obvious: the top 10% who have experienced an unprecedented expansion of their private wealth as financialization bled earnings and diverted the economy’s gains into the incomes and assets concentrated in the top 10%.

Yes, the very same 10% which sits atop every sector in the entire economy, from finance to the media. If we strip away the cultural / political differences in the top 10%–all the hot-button elephants in the room they’re noisily pointing out to the rest of us–we find a foundation of unanimity / consensus that crosses all cultural-political divides: our wealth should continue increasing because we’re so smart / valuable / worthy, and there is no reason for us to sacrifice our wealth to rebalance extreme wealth inequality.

The top 10% is united by their belief that their rocket-launched wealth is earned and deserved, and the “solution” to extreme wealth inequality is to toss a few crumbs at the 90% who have been bled dry / left behind: a handful of subsidized “affordable housing” units, a tax cut of which 95% of the gains goes to the top 10%, and so on: feel-good virtue-signaling that changes nothing in the financial system that generates extreme wealth inequality.

So the “solution” is to leave the engine of extreme wealth inequality running, and pat the rear end of the elephant in the room: you can extricate yourself from the quicksand of precarity and a declining standard of living by becoming an influencer, or day-trader of zero-day-expiration options–the sky’s the limit, baby.

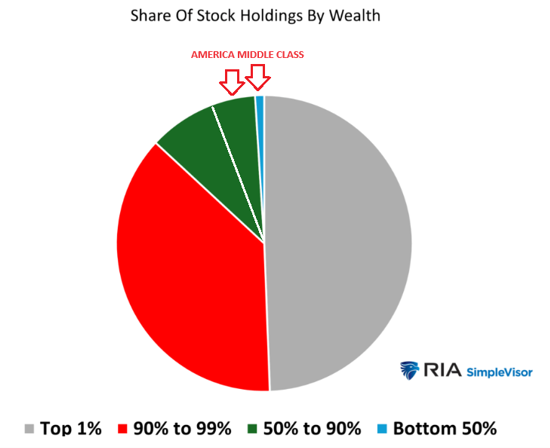

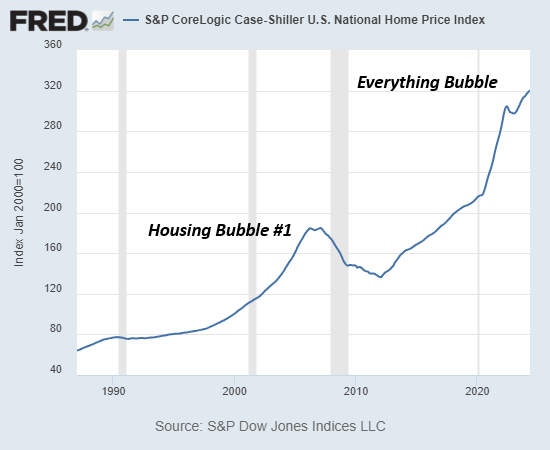

In other words: America is a classless society, anyone can get rich if they work really hard and they play to win in the financialization casino. This illusion of classlessness neatly obscures the reality that virtually all the wealth generated by the economy has flowed to those who bought assets before the Everything Bubble sent asset valuations and finance-related earnings into low Earth orbit.

The employee making $13 an hour in 2010 might make $17 or $18 an hour now, maybe just enough to keep up with the 46% inflation since 2010, or maybe not. Meanwhile, stocks have gone up ten-fold, and housing has risen 2.5-fold. So who fell behind and who got ahead, the wage-earner or the owner of assets?

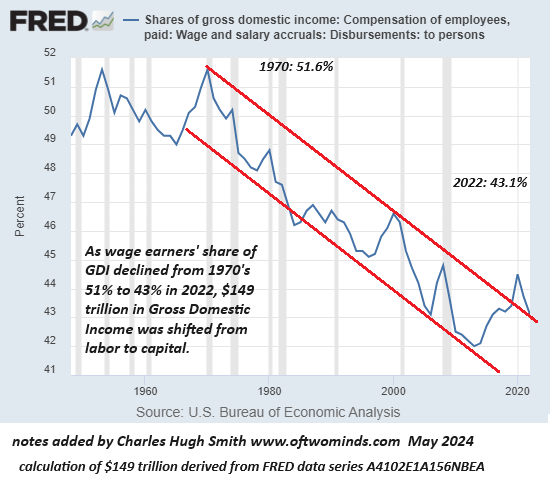

(I maintain a spreadsheet of my earnings adjusted for official inflation and purchasing power–what an hour’s wage could buy in the real world–going back to 1970–and by this measure, I have never earned more in terms of purchasing power than I did in 1976 at the age of 23. Please see the chart below of how wages peaked in the 1970s.)

The ceaselessly repeated cliche is that the system doesn’t generate winners and losers, while the reality is the system generates winners and losers by its very design. Free admission to the casino isn’t actually the same as taking advantage of the games being rigged.

Longtime readers are probably tired of these charts, because they dismantle all the self-serving rah-rah and distractions spewed by the top 10%. The RAND study Trends in Income From 1975 to 2018 concluded that capital skimmed $50 trillion from labor from 1975 to 2018.

Using data from the Federal Reserve’s FRED database (series A4102E1A156NBEA), correspondent Alain M. calculated the actual sum for the period 1970 to 2022 (2022 being the most recent data available) was a staggering $149 trillion: his spreadsheet is available here as a PDF: Employees Share of Gross Domestic Income 1970-2022.

If wage earners’ share of Gross Domestic Income had remained at 51% instead of declining to 43%, wage earners would have received an additional $149 trillion over those 52 years. That’s roughly $3 trillion a year, which works out to an additional $22,000 annually for America’s 134 million full-time workers or an additional $18,000 annually for the nation’s entire work force (full-time, part-time, self-employed, gig workers) of 163 million.

No wonder wage-earners sense their standard of living has been falling for decades: it has been falling doe decades, despite all the cheerleading about what a great economy we have. Yes, but great for who?

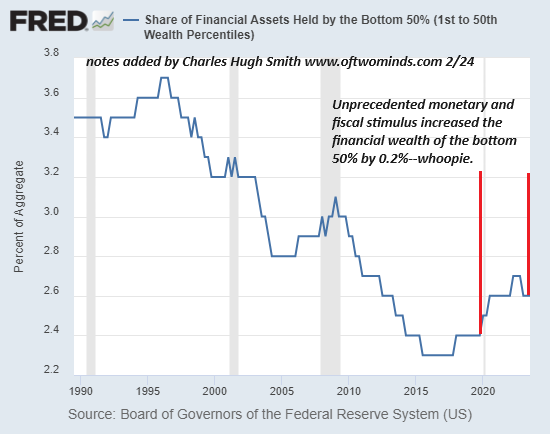

The bottom 50% of American households didn’t get a 10-bagger; their share of the nation’s financial wealth actually fell. We got your great economy right here, big fella:

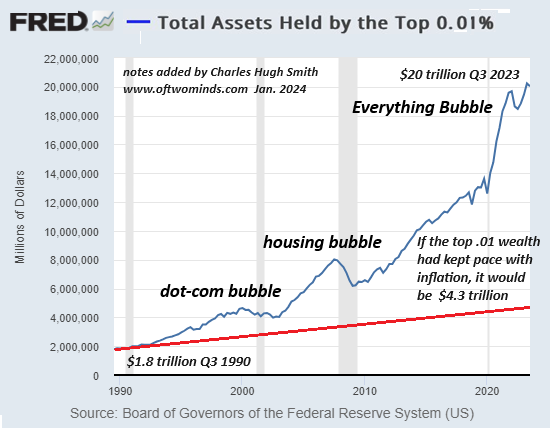

The top 0.01% have had a considerably different experience as their wealth soared far above inflation. These are the folks flustered by the agony of choosing which foreign enclave they’re going to retire to; oh heck, just buy a villa in each one:

It’s a classless society, at least looking down from the top. Those looking up have a different perspective:

What bubble? We don’t see any bubble. No elephants, no bubbles, just blue sky ahead:

Look, I’ve gained ground along with everyone else who bought assets long ago, for the same reason: asset appreciation scooped up all the gains. It wasn’t my smarts, or my education (come on, a degree in philosophy?) or all my hard work (oh, please–all the truly hard work is paid poorly) or anything other than dumb luck.

In my view, there should be zero taxes on all earnings up to the median wage of $60,000 annually–no Social Security taxes, nothing–and progressively steeper taxes on all income / capital gains from capital/finance above some modest amount, say half of the median wage ($30,000 annually), along with a transaction tax for every financial trade submitted, whether it executes or not. Shifting the tax burden from labor to capital/finance would at least start the overdue rebalancing.

So here we are, smugly ignoring the the extreme wealth inequality elephant in the room, hurrying to explain it away with a pat on its rear end. Yes, the economy changed, and by golly, we’re the winners, but it’s not the result of the game being rigged to our favor; it’s globalization, better education, we worked hard. Yes, now it all makes sense: we’re the winners as the natural order of things.

No one is going to finger extreme wealth inequality as the proximate cause of what’s going down in the next decade, but that doesn’t mean it isn’t the tectonic cause. While we’re glorying in the wonders exposed by the sea strangely receding from the beach, we’re blind to the tsunami racing toward us. We don’t call extreme wealth inequality the cause, but that’s the temblor that set the tsunami in motion.

One last thought to those patting the rear end of the extreme wealth inequality elephant on the way out the door to collect their winnings: making the rich even richer with more tax breaks, more financialization, more rigged-casino winnings and continuing to inflate the Everything Bubble (AI!) isn’t going to fix what’s broken; it’s going to hasten the breakdown of the entire status quo, which has put all its chips on capital / finance.

It’s a pretty simple choice: either radically rebalance the economy now or hang on to your beach chair when the wave washes it all away.

The Slow Death of the Single Family Home (30:57 min).

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century

print $18,

(Kindle $8.95,

Hardcover $24 (215 pages, 2024)

Read the Introduction and first chapter for free (PDF)

Self-Reliance in the 21st Century print $18,

(Kindle $8.95,

audiobook $13.08 (96 pages, 2022)

Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

| Thank you, Andre ($70), for your magnificently generous subscription to this site — I am greatly honored by your support and readership. |

Thank you, Peter I. ($70), for your superbly generous subscription to this site — I am greatly honored by your support and readership. |

| Thank you, Robert K. ($7/month), for your marvelously generous subscription to this site — I am greatly honored by your support and readership. |

Thank you, Dave ($7/month), for your splendidly generous subscription to this site — I am greatly honored by your support and readership. |