It's not that hard to forecast a populist revolt against the parasitic class that's grown obscenely wealthy as a direct result of Fed policies.

Under the tender care of the Federal Reserve, America's wealth inequality has skyrocketed to new heights of obscenity as America's billionaires feasted off the Fed's recent stock market rally. By some accounts, billionaire Jeff Bezos added $24 billion to his personal wealth in the past week or two as the Fed's master game plan--push stocks higher, no matter what--has further enriched the few who own most of America's wealth.

To get a handle on the wealth of the stock market's billionaires, please scroll through this site: Wealth, shown to scale (via Maoxian). You'll find that America's private tech fortunes dwarf entire nations' GDP (gross domestic product).

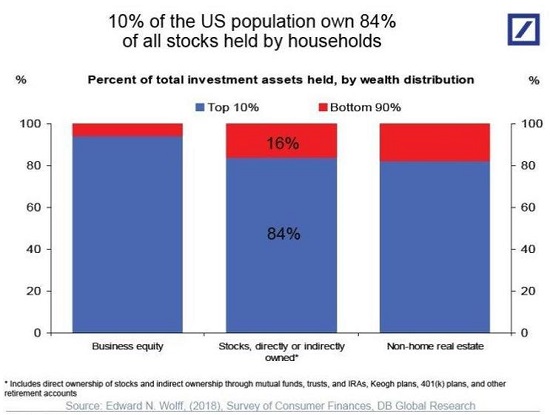

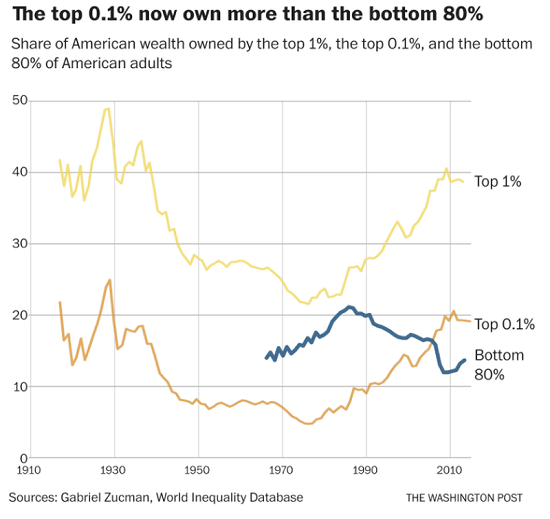

The driver of this fantastic concentration of private wealth is the stock market, the vast majority of which is owned by the top 10% (85%). Within this top 10%, the ownership of stocks, junk bonds, business equity and rental real estate is highly concentrated: the top 5% own roughly two-third's of America's private-sector wealth, the top 1% own 40% and the top 0.1% own 20%. (see chart below)

According to the financial media, the Federal Reserve's super-power--pushing stocks higher no matter what--is the key to the Universe. I beg to differ. The story we're told--"don't fight the Fed"-- is that the Fed's power to push stocks higher is all that's needed to keep the world in a good place--meaning in the hands of the parasitic few who own most of the stocks. (Hiya doin', Warren, Jeff, Bill, Mark...)

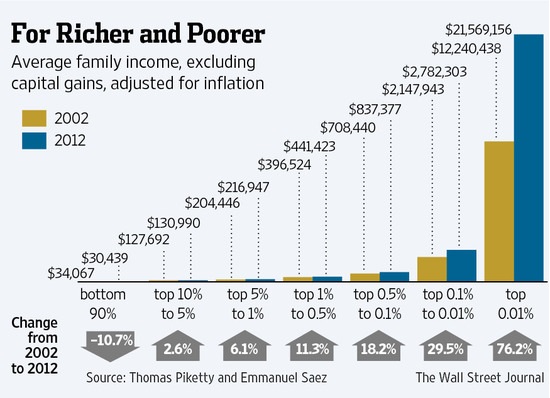

The Fed's policies have created a world in which the top 10% skim an ever-increasing share of the wealth and income and the bottom 90% get more debt. This is a world that is terribly out of balance, as it depends totally and completely on the bottom 90% who own little more than the leftover crumbs of America's wealth borrowing more every year to buy more iPhones, etc., even as their incomes continue stagnating year after year.

The Fed's fix is to lower the interest rate that banks and corporations pay to borrow money from the Fed while interest rates paid by the bottom 90% remain much higher. The Fed's plan is for the bottom 90% to pay a few bucks less for the mortgage so they can pay more interest on other debt.

The dirty little secret is that America's economy implodes once debt stops expanding. The entire machine is completely and totally dependent on debt expanding, even as the incomes of the bottom 90% stagnate. If households and enterprises even reduce their borrowing, i.e. the rate of expansion declines, consumption and bank income crater, and then the defaults explode higher as the declines in consumption trigger lay-offs, business failures and defaults on the ever-rising mountain of debt.

The Fed's sole power turns out to be further enriching the few at the expense of the many. It can't force creditworthy households and enterprises to borrow money they don't need, nor can it generate creditworthy borrowers out of thin air, the way it creates dollars out of thin air.

It can't force banks to loan money to households and enterprises that are not creditworthy, i.e. are very likely to default.

It can't stop the implosion of the U.S. economy once debt expansion reverses, lay-off accelerate and insolvency triggers an avalanche of defaults.

The Fed can't magically make zombie companies solvent, nor can it magically make unprofitable companies profitable.

All the Fed can do is fuel a revolt of the bottom 90% against their parasitic masters, the Fed, and the class the Fed has enriched with their free money for financiers and stock buybacks.

It's not that hard to forecast a populist revolt against the parasitic class that's grown obscenely wealthy as a direct result of Fed policies while millions lose their jobs and what little financial security they once held. The common-sense demand would be: No more bailouts of Wall Street, which includes the big banks, the financiers, the corporations buying back $5 trillion of their own stocks to enrich the few at the top, and the corporations kept afloat with junk bonds and other financial trickery funded by the Fed.

Yet bailing out Wall Street is the Fed's only plan and only super-power. It's the only reason the Fed exists: the parasitic class would wither away without the Fed's constant distortions of what was once known as "the free market." Now the only thing that's free is the Fed's handouts to the parasites at the top.

Let's be clear about one thing: the Fed can fuel the revolt but it can't stop it or control it. Its super-power is limited to 1) enriching the parasitic class and 2) via that distortion, undermining democracy. (I describe this dynamic in greater detail in my book Resistance, Revolution, Liberation: A Model for Positive Change)

Audiobook edition now available:

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Alex T. ($50), for your marvelously generous contribution to this site -- I am greatly honored by your support and readership. | Thank you, Mark J. ($10), for your most generous contribution to this site -- I am greatly honored by your support and readership. |