As the level of Fed smack and crack needed to maintain the high increases, system fragility increases geometrically.

You know the plot point in the horror film where the highway is blocked and a detour sign directs the car full of naive teens off onto a rutted track into the wilderness? We’re right therein the narrative of “the road to recovery”: the highway that everyone expected would be smooth and wide open is about to be detoured into a rutted track that peters out in a wilderness without any lights or signage.

Oops–no cell coverage out here either. Is that the road over there? Guess not–we just careened into a canyon alive with the roar of a raging river. Our vehicle keeps sliding downhill, even with the brakes locked… this trip to “recovery” was supposed to be so quick and easy, and now there’s no way out… what’s that noise?

You know the rest: the naive, trusting teens are picked off one by one in the most horrific fashion.Substitute naive punters in the stock market and you have the script for what lies ahead.

The “recovery” has an unfortunate but all-too accurate connotation: recovery from addiction.The “recovery” we’ve been told is already accelerating at a wondrous pace does not include any treatment of the market’s addiction to Federal Reserve free money for financiers; rather, the “recovery” is entirely dependent on a never-ending speedball of Fed smack and crack and a booster of Fed financial meth.

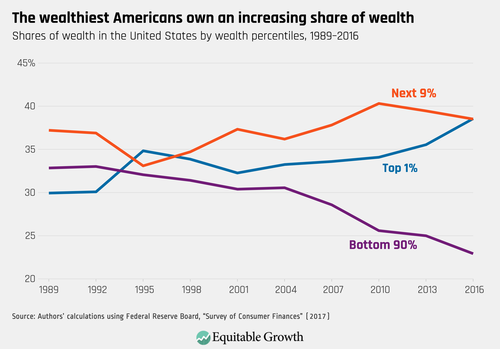

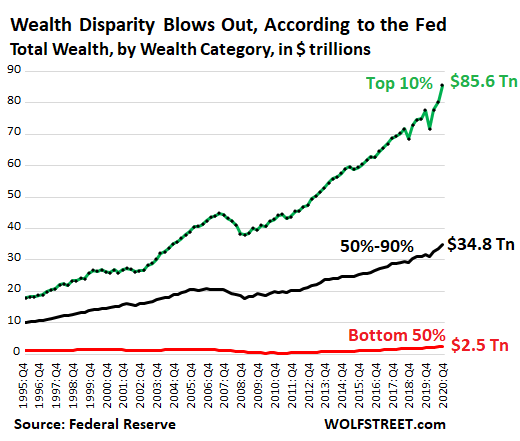

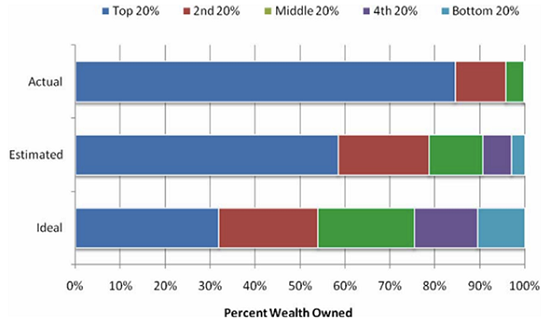

The addiction to Fed speedballs had already turned the entire financial sector into a casino of lunatic junkies who delusionally believe they’re all geniuses. Beneath the illusory stability of the god-like Fed has our back, the addiction to free money has completely destabilized America’s social, political and economic orders by boosting wealth and income inequality to unprecedented extremes.

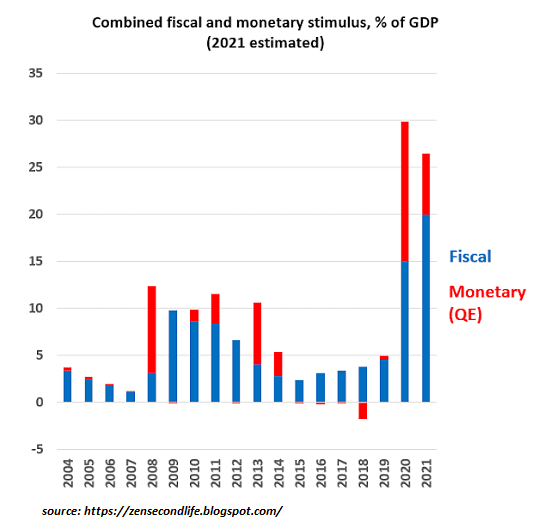

While it’s convenient to blame the carnage on the response to the Covid pandemic, the damage to the speedball-addicted financial system had already reached extremes before the pandemic:the addiction began decades ago, but like all addictions, the amount of stimulus needed to maintain the high keeps expanding, and eventually the need can’t be met without toxic doses: then the junkie / addicted system collapses.

The ever-greater doses of Fed speedballs have unleashed both deflation (smack) and inflation (crack): real returns on ordinary savings have been crushed to zero (deflation of ordinary income), and as the cost of capital/credit have been dropped to near-zero, then the purchasing power of wages has deflated while the speculative gains of those who own assets have soared (asset inflation).

By lowering the cost of capital to zero, the Fed has generated fatally perverse incentives.With the cost of capital at zero, it makes sense to buy labor-saving technologies to replace costly labor– labor that is costly to employers because of America’s perverse sickcaresystem, which burdens employers with ever-higher costs.

Not only have the Fed’s free-money speedballs made it essentially free for financiers to speculate in the stock market casino, the Fed has rigged the game and bailed out its cronieswhenever their bets soured. This has fueled infinite moral hazard: Go ahead and gamble with free money from the Fed, and go ahead and leverage it up 10-to-1 because the Fed will bail you out if you lose, but if you win, the stupendous gains are yours to keep.

The problem with addiction is you’re dependent on the high, no matter what the eventual consequences may be. Long-term consequences are ignored because all that matters to the addict is to get the next Fed speedball and throw it on the gambling table to keep the high going.

Our entire economy is now dependent on ever-expanding speculative gains. Should the casino winnings falter, our economy will crash, and given the primacy of money and consumption in our society and political system, the financial collapse of the Fed’s casino lunacy will sweep those systems over the falls.

As the level of Fed smack and crack needed to maintain the high increases, system fragility increases geometrically. The irony of addiction is that when the crack/meth kicks in, the addict feels god-like, in control, invulnerable. This artificial confidence is entirely illusory, a deadly combination of delusion and hubris.

In this delusional state of supreme confidence, the addict loses touch with reality, i.e. the fatal consequences of the addiction. That’s the detour we’ve taken in becoming addicted to the Fed’s free-money speedballs. Now the rutted road has ended in a trackless wilderness. There is no way back and no way forward. The addict’s addled confidence will push them into the ice-cold river, and as they’re swept over the falls, the realization that it was all a drug-induced delusion will come too late to make a difference.

This essay was first published as a weekly Musings Report sent exclusively to subscribers and patrons at the $5/month ($54/year) and higher level. Thank you, patrons and subscribers, for supporting my work and this free blog.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My new book is available!A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet 20% and 15% discounts (Kindle $7, print $17, audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Podcasts:

AxisOfEasy Salon #40: Subprime Attention NFTs (1:01 hrs) –NFTs–non-fungible tokens…

Disconnects between the Economy and the Financial Markets (FRA Roundtable, 41 min)

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic($5 (Kindle), $10 (print), (audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake$1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)Read the first section for free (PDF).

Become a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, Bindu M. ($50), for your superbly generous contribution to this site — I am greatly honored by your steadfast support and readership. | Thank you, James S. ($5/month), for your outrageously generous contribution to this site — I am greatly honored by your support and readership. |