The younger generations expecting to inherit the immense wealth piled up by Boomers in home equity and stocks may be in for a shock.

I’ve reached the point in life where I see a sharp line dividing the adult populace: there are those of us who are old enough to retire who are taking care of very elderly parents / family members at home, and then there’s everyone else.

Instead of life getting easier as we age, it gets harder–much harder , as we no longer have the same energy we had in our 40s and 50s.

This article captures what life is like for those of us fulfilling parents’ wishes to live out their final years at home: The Crushing Financial Burden of Aging at Home: Families face soaring costs and mounting pressures in taking care of their loved ones. ‘I never feel truly free.’ (WSJ.com)

In my case, we spent the last 8 years taking care of my mother-in-law, the last 6 years of her life here at our home. (She passed away at 92 last year.) So from ages 62 to 70, we had two jobs: caregiving and our self-employed paid work. In those years, we managed one vacation–not exactly the ideal retirement scenario.

Many others have it much worse: they’re caring for an elderly, ill parent or spouse by themselves, with limited financial resources. Those who opt to pay for 24/7 home care for parents or spouses with dementia or Alzheimer’s are paying $240,000 a year–a sum that will consume the entire wealth of most families in a few years:

Here are excerpts from the article:

“Americans want to grow old in their own homes. But pursuing that dream has gotten harder, and is putting huge financial and emotional strains on families.

In Nebraska, Christine Salhany spends about $240,000 a year for 24-hour in-home care for her husband who has Alzheimer’s. In Illinois, Carolyn Brugioni’s dad exhausted his savings and took out a home-equity line-of-credit to pay for home healthcare.

Traci Lamb closed her business to take care of her mom in Florida. And in California, Cheryl Orr delayed retirement to help pay for care and home modifications for her wife, who has dementia.

Soaring costs of in-home care, medical advances that extend lives but require ongoing help, and the growing ranks of older baby boomers are creating new pressures. Spouses, adult children and siblings are putting their lives on hold to care for relatives, wrestling with sleep deprivation and constant worry. Families are draining savings to hire help, pay for medical care, and modify homes.

More than 11,000 people in the U.S. are turning 65 every day and the vast majority–77% of Americans age 50 and older according to an AARP survey–want to live as long as possible in their current home.

Those needing round-the-clock in-home care can expect a median cost of about $290,000, which is more than double the annual median cost of a private room in a nursing home facility and four times the annual median cost of a private room in assisted living, according to Genworth.”

The drain on caregivers isn’t just financial–it’s physical and emotional:

“I have to be very vigilant. I never feel truly free,” says Christine. That is a feeling expressed by many. Four in 10 family caregivers rarely or never feel relaxed, according to a 2023 AARP survey. Dementia care is among the most taxing, physically, financially and emotionally.”

For those families opting to place a parent or spouse in an institutional care facility, the cost is around $13,000 a month and up. Assisted living and private care homes generally cost between $6,000 and $9,000 a month.

How many families have the means to pay these rates for years?

My Mom is 95 and has lived in an assisted living/care facility that she bought into 18 years ago with the proceeds from selling her house. The monthly fees have consumed her own inheritance from her parents, who passed away in the late 1980s.

My siblings and I are relieved that there are still funds to pay for our Mom’s care. That there is no inheritance doesn’t matter; what matters is that we’re not burdened with enormous monthly fees for her care in our own retirement.

We are not alone. Our neighbors are 80 years old and they recently moved her 102-year old mother from their home to a care home, as she and her husband could no longer lift her Mom out of bed.

In many cases, the caregivers don’t get to actually retire until they’re well into old age. Family conflicts arise as some adult children refuse to do their share, burdening one sibling with the workload and financial costs.

People living longer put an enormous strain on families and the government. The wealth that was intended to be an inheritance passed onto children and grandchildren is consumed by elderly care: at $150,000 a year, even $1 million is consumed in a few years.

The strategy pursued by many families is to transfer ownership of the parents’ home to the adult children long before retirement, so the parent’s remaining assets will be modest enough to qualify for Medicaid, where the federal government pays for the parents’ care home expenses.

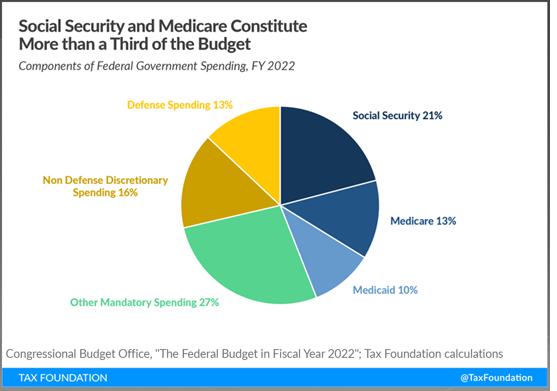

Federal programs for retirees, the disabled and the elderly already consume 44% of the budget, and this percentage will rise sharply in the decades ahead.

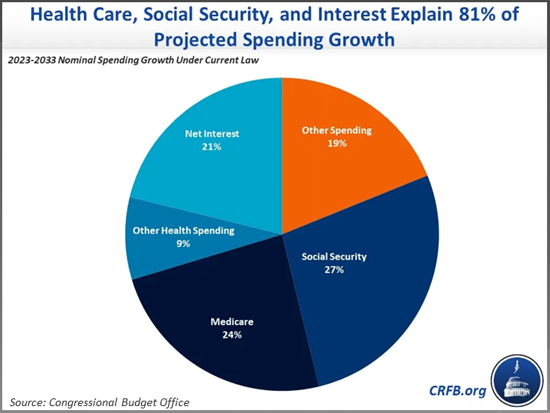

As we all know, the federal government is already borrowing trillions of dollars to cover its ballooning expenditures, and 80% of the expected growth of federal spending is Social Security, Medicare, Medicaid and interest on the debt.

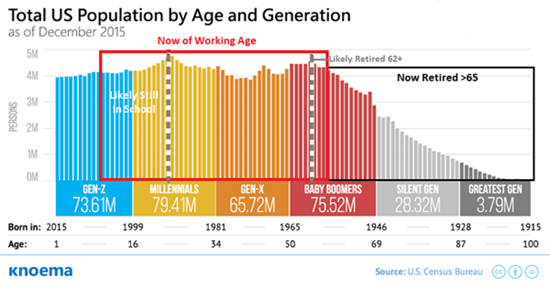

As the 70+ million baby Boomers (those born between 1946 and 1965) retire, how will families and the nation pay for the retirement of a generation of this scale? As this chart illustrates, in retirement, the Boomer generation will be more than twice the size of the preceding Silent Generation.

As a rough estimate, let’s say there will be 30 million more elderly than there were in the previous generation–the equivalent of adding an entire nation of elderly retirees. Yes, many elderly people continue working into their 70s and 80s, and many are still living alone and do not need any assistance. One of our neighbors is a World War II vet who is 102, and he still drives and lives on his own. But he is an outlier. Few reach old age without needing assistance of some kind.

The decline of the population’s health as poor diet and inactive lifestyles take their toll will heavily impact the Boomers’ need for care. And the decline in the health of younger generations will also impact the ability of the nation to fund the costs of caring for 60 to 70 million elderly and supply the workforce to provide all the care.

Anecdotally, there is little evidence that new care facilities are being built at a rate anywhere close to meeting the future need for such facilities. Even if elderly Boomers wish to move out of their own homes into a care home, there may not be enough facilities to meet demand. There may be few options to spending one’s last years at home, but with what level of care if that care costs $13,000 a month–$156,000 a year?

The younger generations expecting to inherit the immense wealth piled up by Boomers in home equity and stocks may be in for a shock as they learn that 24/7 home care for a grandparent with dementia costs $250,000 a year unless they provide the care themselves, and that even modest care facilities can cost $100,000 a year.

Combine the popping of the Everything Bubble with the rising costs of care, and it becomes apparent that dreams of inheriting fortunes are as unrealistic as the dreams of 60 to 70 million elderly Boomers of living comfortably at home with caregivers doing all the work.

The retirement hopes of those with elderly parents to care for will also go up in smoke, as I can attest from our own experience: the Golden Years of one’s 60s and 70s can be consumed by caregiving, at the cost of one’s own retirement funds and health.

It’s estimated that around 30% of the debilities of aging are the result of genetics; the other 70% are the result of our lifestyle and life choices. Piling up money in the hopes it will be enough may not be enough. The higher-return investment may well be in radically changing our lifestyle to become as healthy as possible as we age so we won’t need the kind of care that will bankrupt families and the nation.

New podcast:

Is the Everything Bubble About to Pop? (37 min, 40 charts)

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18,

(Kindle $8.95,

audiobook $13.08 (96 pages, 2022)

Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

| Thank you, James P. ($200), for your beyond-outrageously generous founding membership — I am greatly honored by your support and readership. |

Thank you, Pro5 ($4.50/month), for your superbly generous patronage to this site — I am greatly honored by your support and readership. |

| Thank you, MM ($3/month), for your most generous patronage to this site — I am greatly honored by your support and readership. |

Thank you, Donald W. ($70), for your outrageously generous subscription to this site — I am greatly honored by your support and readership. |