So hey, central bank cheerleaders, lackeys, toadies, apologists, apparatchiks and sycophants: no, the central banks aren’t going to “save” your precious asset bubbles from popping.

There’s a fanciful confidence afoot that central banks will once again coordinate a global “save” as markets careen out of control. They won’t. There are many reasons for this:

1. There is no incentive to coordinate efforts, as each nation/region has vastly differing interests. Each faces a different mix of real-world inflation / deflation of assets, stagnation, currency issues and competing domestic / global interests.

On top of those diverging interests, a low-level “economic warfare” is being waged between dysfunctional co-dependents China and the US, which are like a co-dependent couple who want a divorce but need each other to pay the bills, all the while pridefully (and falsely) claiming they can easily do without the other.

2. The era of low inflation has ended, and so has the era of ZIRP (zero-interest rate policies). The central banks are now perched on the horns of a self-inflicted dilemma: to boost flagging growth, they need tp lower interest rates (their “one weird trick” they picked up off a spam site somewhere), but since they let inflation become embedded and geopolitics is jacking up real-world costs, the usual tricks of dropping rates to near-zero and flooding the financial system with “free money for financiers”, a.k.a. liquidity, will reignite still-simmering inflation.

3. The statistical gaming can’t hide the fact that inflation is still crushing wage earners. The statistical game is that inflation is measured year-over-year, as if it magically resets every year. But it doesn’t reset; all the inflation of the previous years is still present, burdening wage earners.

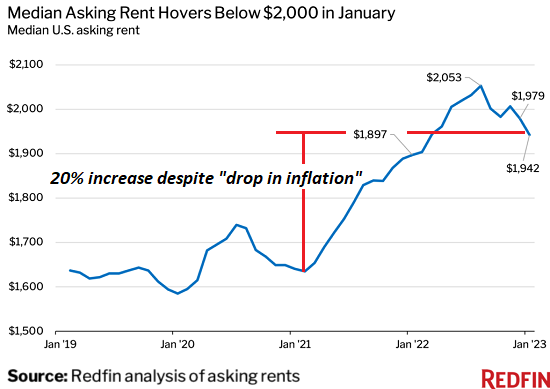

Consider residential rents. The financial media is slobbering all over itself in its rush to declare that “rents are softening” and rent inflation is dead. You mean rents have fallen back to where they were in 2020? Of course not; all those gargantuan rent increases (and other manifestations of inflation in other sectors) of the past few years are still strangling renters.

As the chart of asking rent below shows, even after “softening,” rents are still 20% higher.Those increases are still crushing wage earners.

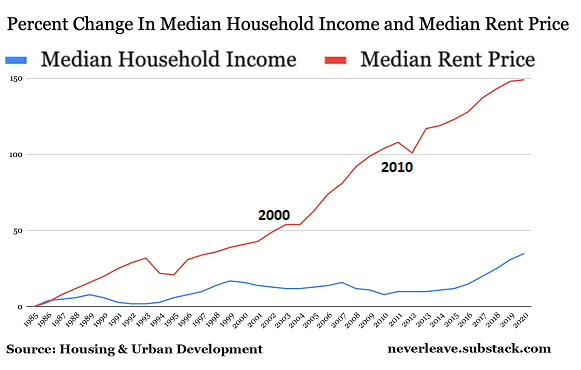

4. Wages have not caught up with either real-world inflation or asset bubble inflation. The chart of rent and household income reflects the unhappy reality that wages have lagged for 45 years, and continue to lag.

All the central bank-stimulated “growth” ended up in the wealth of the top 10%, not the populace’s earned income. This reality has finally entered the public awareness, and so central banks can’t goose the wealth of the top 10% under the guise of “stimulating economic growth.”

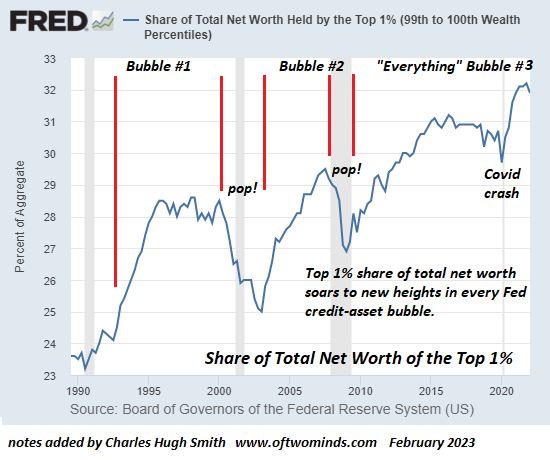

I’ve posted the chart of the stupendous expansion of the wealth of the top 1% many times: it is the one fundamental restructuring result of central bank stimulus / intervention.

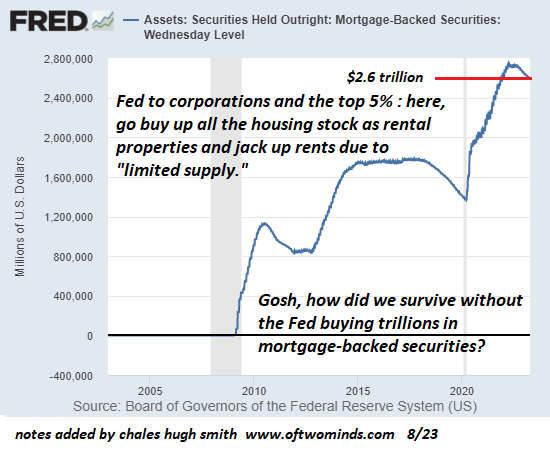

5. The destabilizing extremes of wealth-income inequality generated by central banks are now shackles on its policy options. All the central bank tricks did was ignite a rocket under wealth-income inequality that then bled into the housing market, poisoning it by concentrating ownership of the housing stock in rapacious slumlord corporations and the top 10% who scooped up hundreds of thousands of dwellings as short-term vacation rentals, investment properties and speculative dumping grounds for their “excess capital.”

Note my question on the chart of the Fed’s ownership of mortgage-backed securities (MBS) which shot from zero to $2.6 trillion in a few years: how did we survive before constant Fed stimulus / intervention on behalf of corporations and the top 10%?

So hey, central bank cheerleaders, lackeys, toadies, apologists, apparatchiks and sycophants: no, the central banks aren’t going to “save” your precious asset bubbles from popping. Every central bank “save” further distorted the financial system and the economy, to the detriment of the populace and social stability.

The costs and consequences of central bank distortions have finally come home to roost. The vultures are circling the asset bubbles, awaiting their opportunity to pick over the carcasses of all those who reckoned “central bank saves and asset bubbles are forever.”

As for everyone else: you’re on your own. Nobody’s going to “save” us. The good news is that this is a tremendous opportunity to expand our self-reliance and reduce our exposure to risks we don’t control.

Those edging toward the exits are murmuring, “I Have a Very Bad Feeling About This.”

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

| Thank you, Steve M. ($5/month), for your splendidly generous subscription to this site — I am greatly honored by your support and readership. |

Thank you, Glenn A. ($5/month), for your marvelously generous subscription to this site — I am greatly honored by your support and readership. |