The choice is simple: housing is either shelter for citizens, or it’s just another interchangeable speculative asset in the global financialization casino. It can’t be both.

We tend to think of housing becoming unaffordable as a matter of land prices, zoning and the cost of 2X4s, but it’s fundamentally a matter of values. Subscriber John summarized this in an insightful comment on Substack:

“For me, this issue is a reflection of the values of our culture.

1. Lack of value placed on community means that a house is primarily a financial asset, not a home.

2. Lack of valuing community, means that we have not supported local business / industry and allowed these to be centralized or outsourced.

3. Lack of valuing self-sufficiency means that the only way we can view a house as an asset is when it increases in value. How much income does your house generate every month? (even if you count that income in tomatoes).

Most of the housing being built is nothing more than boxes with a roof no matter how fancy the box. There is no awareness of how that housing is a part of the ecology that it is built in.”

This boils down to a simple choice: either housing is shelter for the citizenry, or it’s just another asset class to be snapped up for private profit / gain by global capital. Choose one. This is one of the many pernicious consequences of glorifying Financialization as the most important dynamic in our economy and society.

Once an economy has been financialized, everything becomes a commodity in the global marketplace to be bought and sold as an interchangeable asset. A flat in Bangkok, a flat in Barcelona, a flat in Miami: they’re all the same to global capital, which includes trillions of dollars of non-U.S. wealth sloshing around seeking profitable places to park surplus capital, and domestic wealth doing the same thing, moving wealth around interchangeable assets to maximize private gain.

This is the iron logic of Financialization and Globalization: housing is just another asset class to exploit. What effect the tsunami of wealth has on the communities being shredded is of zero interest to non-resident owners, corporations and speculators. Buying up houses to rent as short-term vacation rentals (STVRs), or simply left empty is just like buying a corporate bond: you move your capital around to maximize private gains, there’s no difference between housing, shares in a mining company, bonds or any other financial commodity.

This is how you end up with entire residential buildings having only a few residents, as 90+% of the owners don’t live there, they just own the flat or house as a place to safely park surplus capital or visit a few days of the year on vacation. This is a global reality that anyone can observe who cares to open their eyes.

Is housing shelter for citizens or is it a commodity asset one buys for profit as a mini-hotel? In popular tourist areas, consequential percentages of the housing has been snapped up by the wealthy as STVRs, short-term rental housing, the vast majority of which are owned not by hosts who live in the house as their sole residence but by absentee hosts who live half a world away and who have zero interest in the locale or community their interchangeable rental happens to be in.

Restrictions on new housing serve the self-serving interests profiting from locking down the status quo. Anything that might negatively affect valuations is resisted. This urge to pull the ladder up behind us is natural, but is it fair to the generations behind us? As for all the restrictions, regulations and permitting–has anyone looked at this mass of costs with fresh eyes, asking if it’s truly serving the citizenry? Or can much of it be stripped away as bureaucratic clutter or lobbying imposed by self-serving interests? We need to ask cui bono— to whose benefit?

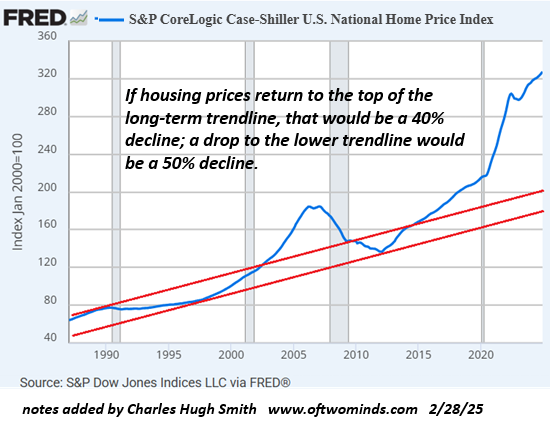

Everyone is for solutions to housing unaffordability that don’t diminish the value of their house. But the price is the problem. As I explained in Housing: The Foundations of the Middle Class Are Crumbling, turning housing into just another table in the financialization casino has inflated a bubble of unprecedented proportions that has distorted not just affordability but the fabric of society.

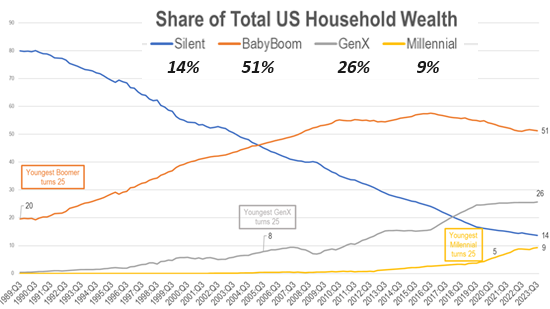

Those who bought homes long ago are now wealthy not from genius but simply from timing. Buying in before the bubble inflated has generated generational and regional divides of the haves and the have-nots that are corrosive to the economy and society.

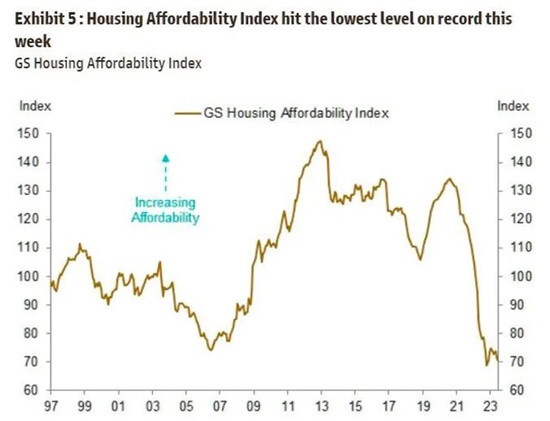

Let’s start with housing affordability. It’s in the basement.

The generations who bought homes 25 or more years ago have accumulated most of the wealth. When houses increase in value ten-fold while wages rise by a third, this is the result:

Here’s the National Case Shiller Housing Index. I’ve added long-term trendlines to clarify the two housing bubbles inflated by rampant financialization. A return to the upper trendline would require a 40% drop in current valuations, and a return to the lower trendline would require a 50% decline.

Since financialization inflated housing to unaffordable heights, the only way to restore affordability is to eliminate the perverse incentives and distortions of financialization by taking these steps to return housing to sheltering the citizenry:

1. Impose a national ban on all short-term vacation rentals except those hosted by full-time owner-occupants. Those caught cheating would be fined $10,000 per violation (i.e. each rental to a new vacationer), with no upper limit.

I know all the rationalizations, hut here’s the thing: if you want to own and operate a mini-hotel, go build one in a resort / commercial zone. Residential housing is for residents, not a place for global capital to park surplus wealth or stripmine for private gain.

Those full-time owner-occupants who want to rent out a room in their house to vacationers, that’s fine.

2. Impose national limits on non-resident ownership of housing. An outright total ban on non-resident ownership of housing would be best, but if that’s politically impossible, then requirements for residency would be the next best thing: if the owner leaves the home empty for 6 months or longer, a $100,000 fee is imposed annually. Anyone caught cheating would be fined the current value of the home.

Once again, the choice is simple: housing is either shelter for citizens, or it’s just another interchangeable speculative asset in the global financialization casino. It can’t be both. Rationalizing excuses that it can serve both is why the few profiting from the rationalizations are so desperate to obscure this simple, fundamental choice.

The third solution is to open the locked doors of zoning, planning and industry standards to new types of housing that would be unconventional but affordable. Every locale will have to wrestle with the forces of keeping the status quo locked down and the need to loosen restrictions and free up experimentation in housing. There isn’t one-size-fits-all; every community will have to establish what works best for their economy and populace.

One system builds communities, another destroys them. Take your pick, but choose wisely.

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century

print $18,

(Kindle $8.95,

Hardcover $24 (215 pages, 2024)

Read the Introduction and first chapter for free (PDF)

Self-Reliance in the 21st Century print $18,

(Kindle $8.95,

audiobook $13.08 (96 pages, 2022)

Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

| Thank you, Cheryl N. ($100), for your outrageously generous subscription to this site — I am greatly honored by your steadfast support and readership. |

Thank you, Jerry K. ($100), for your outrageously generous subscription to this site — I am greatly honored by your steadfast support and readership. |

| Thank you, Lindsay M. ($70), for your magnificently generous subscription to this site — I am greatly honored by your support and readership. |

Thank you, Riderslb123 ($70), for your splendidly generous subscription to this site — I am greatly honored by your support and readership. |