Maybe maximizing corporate profits isn’t all that matters. Maybe national security and resilience matter, too, and if they do, then reshoring critical supply chains should be a higher priority than Corporate America’s (mostly tax-free) profits.

As America’s trade deficit explodes higher and the costs of offshoring supply chains mount, the apologists for globalization are out in full force, attempting to shout down reality with their usual specious claims about how amazingly wunnerful globalization has been for America.

Allow me to tote up the real-world cost savings:

Cost of cheap ill-fitting jeans dropped $10.

Cost of low-quality TV that will only last a few years dropped $50.

Cost of healthcare, annual increase: $3,000 per household

Cost of rent, annual increase: $1,200 per household

Cost of child care, annual increase: $1,300 per household

Cost of college tuition and room and board, annual increase: $1,500 per household

So while domestic costs rose $6,000 annually due to predatory cartels, over-regulation, taxes, etc., we saved $60 by offshoring supply chains. Excuse me for being underwhelmed by the wunnerfulness of offshoring jobs and supply chains.

Yes, the benefits of free trade, blah-blah-blah, I get it; but there is no such thing as free trade, there are only versions of managed trade, the vast majority of which are beneficial to corporations and elites on both sides of the trade.

Trade is always about maximizing profits. That’s the only reason to bother with trade, though there are geopolitical considerations as well. The U.S. opened its vast markets to Western Europe and Japan and the Asian Tigers in the Cold War to strengthen their economies, as a means of suppressing the appeal of Communism in their domestic politics.

This mercantilist strategy worked well, ushering in rapid growth in West Germany, Japan and other allied nations, but the problem is those economies never transitioned out of being mercantilist, export-dependent economies. The U.S. has remained the dumping ground for the world’s surplus production since the early 1950s.

While it’s all too easy to blame China for soaring trade deficits, nobody forced Corporate America to transfer supply chains to China; it was all done to maximize profits, because that’s all that matters, right?

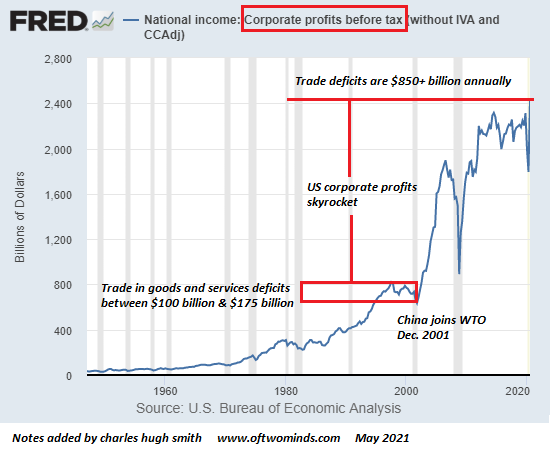

If we examine the chart of U.S. corporate profits, we notice they were around $700 billion annually in the high-growth 1990s when America’s trade deficit in goods and services fluctuated between $100 billion and $175 billion annually. Once China entered the World Trade Organization (WTO) in 2001, corporate profits — and trade deficits — skyrocketed.

This is not coincidence. Corporate America reaped trillions in profits by offshoring production and supply chains. Three points need to made here: one is that trade in goods is grossly distorted by outdated rules for calculating imports and exports. Analysts estimate that as little as $10 of the value of every iPhone or iPad actually ends up in the Chinese economy, in the form of income paid directly to Foxconn or other contractors. But the iPhone–assembled in China with parts sourced globally–is counted as a $250 import from China when it arrives at the port of Long Beach, California.

The other is that China paid a steep price for its rapid economic growth as the sweatshop for global corporations. The environmental damage of rapid industrialization has been immense, many workers were cheated by contractors who promised impossibly low prices to Western corporate buyers, and profit margins were razor thin for many suppliers.

The American workforce paid a steep price, as did U.S. national security, as valuable intellectual property was lavished on China in exchange for those all-important quarterly increases in corporate profits.

Corporate America made out like bandits. Everyone else–not so much. Thanks to fancy legalized looting footwork, most American corporation reaping staggering profits from overseas production pay little or no taxes that benefit the American citizenry.

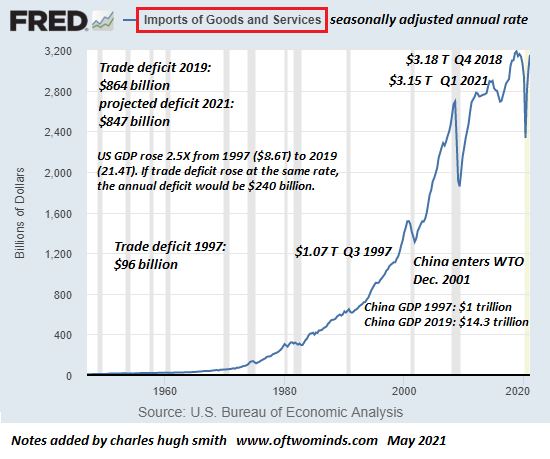

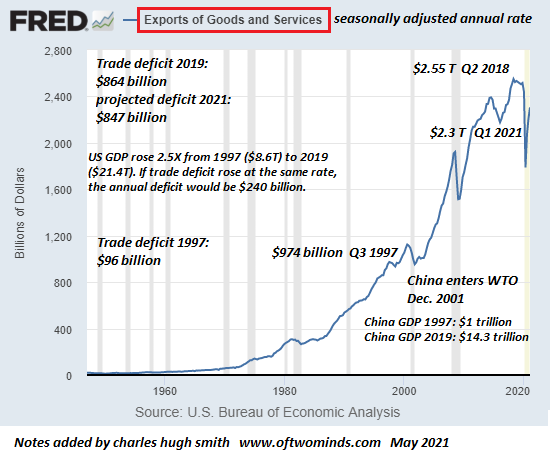

Let’s look at the charts of U.S. imports and exports. If trade deficits had risen along with U.S. gross domestic product (GDP) in the 24 years since 1997, it would have risen 2.5-fold, to an annual rate of about $240 billion.

The actual trade deficit is $600 billion higher: $850 billion annually. $600 billion here, $600 billion there, pretty soon you’re talking real money.

Notice that thanks to trillions in stimulus, imports have soared back up while exports have lagged. That’s what happens when you offshore your critical supply chains.

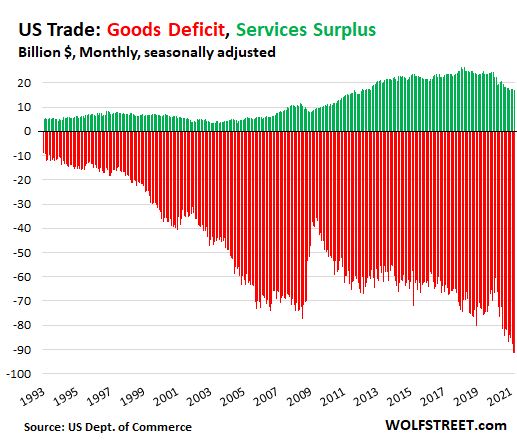

My insightful blogger colleague Wolf Richter recently posted an illuminating chart of service surpluses and goods deficits: it’s obvious that much of the stimmy spent at WalMart bought stuff from China.

He added these thought-provoking comments in his postJust Keeps Getting Worse: Services Trade Surplus, the American Dream Not-Come-True, Falls to 9-Year Low, Total Trade Deficit Explodes to Worst Ever:

“Note that during the Financial Crisis, the overall trade deficit improved substantially. Consumers cut back buying imported durable goods, while the trade surplus of services declined only briefly.

The opposite happened during the Pandemic where stimulus fired up US consumer demand, boosted foreign manufacturing, but did nothing for US exports.

Every crisis in the US over the past two decades has caused Corporate America to cut costs further by pushing offshoring to the next level. And after each crisis subsides, the trade deficits and US dependence on foreign manufacturing plants (no matter who owns them) are worse than before.

This dependence has become painfully obvious in some of the shortages, including the semiconductor shortage now rippling through the US economy. The US, which for decades had led the world in semiconductor design and manufacturing, now makes only 12% of global semiconductors.”

Maybe maximizing corporate profits isn’t all that matters. Maybe national security and resilience matter, too, and if they do, then reshoring critical supply chains should be a higher priority than Corporate America’s (mostly tax-free) profits.

Of related interest:

Forget “Free Trade”–It’s All About Capital Flows (3/9/18)

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My new book is available!A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet 20% and 15% discounts (Kindle $7, print $17, audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Podcasts:

Salon #43: History shows again and again how nature points out the folly of men…

Covid Has Triggered The Next Great Financial Crisis (34:46)

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic($5 (Kindle), $10 (print), (audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake$1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)Read the first section for free (PDF).

Become a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, Bill G. ($5/month), for your superbly generous pledge to this site — I am greatly honored by your support and readership. | Thank you, Greg H. ($5/month), for your outrageously generous pledge to this site — I am greatly honored by your steadfast support and readership. |