History suggests such a stratified society cannot endure as a democracy.

When we say “The Wealthy Are Not Like You and Me,” most people will assume we’re talking about

ultra-high-net-worth individuals (UHNWIs) with $30 million or more in assets or even the hyper-rich worth hundreds of millions or billionaires.

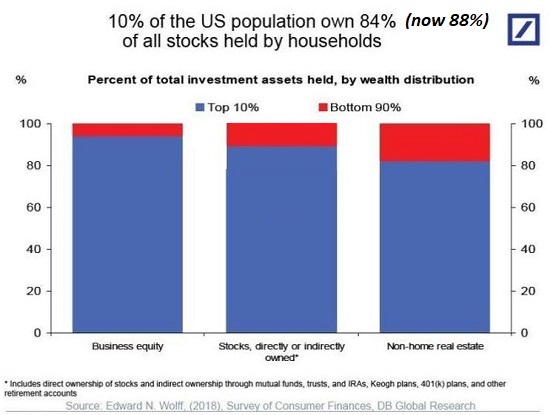

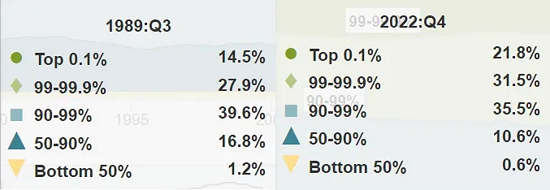

I’m not discussing the tiny class of UHNWIs here, I’m discussing the 8 million households of the top 5% and the 13 million households of the top 10% who own 70% of all assets and almost 90% of income-producing assets such as stocks, bonds, rental properties, etc. Not the uber-wealthy or hyper-wealthy, just the wealthy who own a million or two in assets not counting their primary residence.

A recent survey reports that there are 13.6 million households that have a net worth of $1 million or more (about 10% of the 132 million US households), and about 8 million US households have a net worth of $2 million or more (about 6% of households), not including the value of their primary residence. .

This top 10% collect about 50% of all income and account for about 40% of all consumption.

The topic here is the increasingly impermeable barrier between the top 5% and the bottom 95%,

a matter not just of financial inequality but of sociological separation discussed by Christopher Lasch in his 1996 book

The Revolt of the Elites and the Betrayal of Democracy.

I want to stipulate that I am not slamming the class of people I’m describing here. Rather, I am observing them as an anthropologist observes tribes, classes and cultures.

I recently met up with some old friends from our college days. At the time, they were students living in a cookie-cutter high-rise apartment with the usual hand-me-down furniture and concrete-block / pine boards book-shelving.

Now they live in a multi-million dollar house in an exclusive neighborhood, surrounded by $5 million McMansions recently built on small lots after the original homes were demolished. They too demolished the house inherited from parents and built a new luxe home.

What struck me as a journalist / analyst was how wealthy there are, and how all their friends are wealthy. They don’t interact with the bottom 95% of “normal” people except as their housecleaning maids, repair or delivery person, etc., as interchangeable, commoditized laborers who are effectively peasants / peons in our highly stratified neofeudal economy. They don’t actually know any “normal” people as friends or even colleagues; their friends are all wealthy people like themselves.

We might say this impermeable class divide is natural, but this overlooks three key factors.

One is that the barrier between the wealthy and the not-wealthy was once more permeable. As Lasch observed, America’s elites have separated themselves from the rest of society in exclusive enclaves and in a mobile lifestyle detached from place.

Other commentators have written about the same sociological trend of elites living in bubbles populated by other elites: in elite universities, in exclusive social groups, in exclusive neighborhoods no normal household can possibly afford, etc.

Lasch’s point was this economic / lifestyle stratification is toxic to democracy, a reality that is playing out in all sorts of ways.

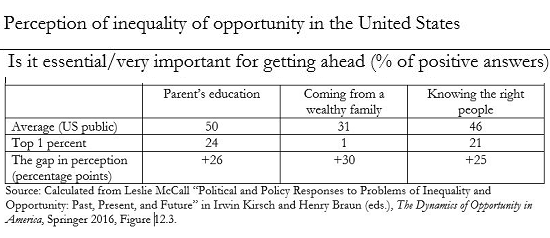

Another factor is all the wealthy people I know became wealthy as a direct result of financial help from their parents. Every wealthy person I know (with a very few exceptions)–and by that I mean people who live in homes worth $750,000 or more in value and who own other substantial financial assets that generate capital gains and income–attended university funded by their parents, and whose first home purchase was enabled by help from their parents or in-laws.

I’ve also observed that this class of privileged people often tout their “bootstrapping” while neglecting to list the full measure of financial support they received from their family. Everyone wants to claim “I did it all myself” but this rings hollow once the facts of the matter come out.

This class also inherited substantial wealth when their parents passed away, or from trusts established by the parents to transfer their wealth prior to their death.

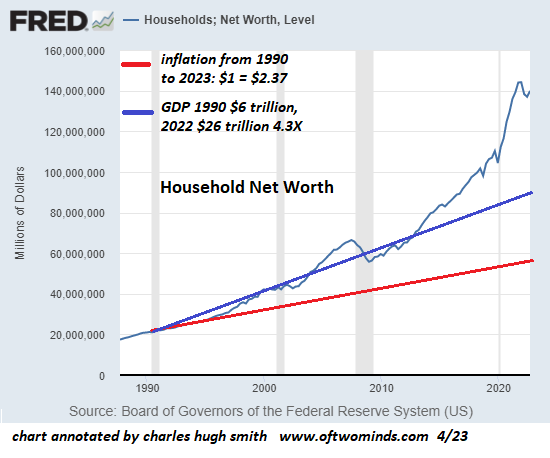

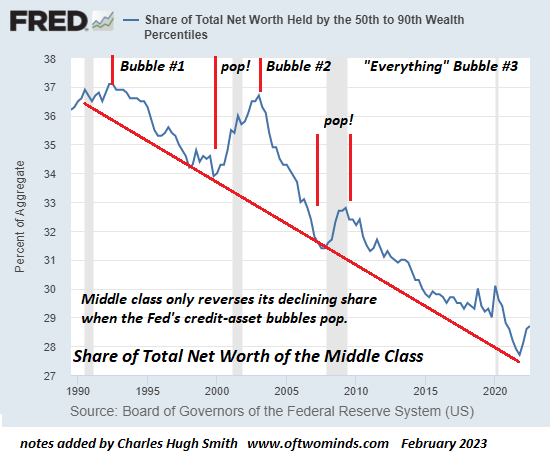

Lastly, all the wealthy people I know bought or acquired assets long ago at prices that were affordable to households with normal middle-class incomes. At today’s valuations, the homes and assets they bought decades ago are no longer affordable to any household below the top 10%.

Another shared characteristic of the wealthy who inherited their wealth and benefited tremendously from the past 30 years of asset inflation is that they uniformly attribute their wealth to their hard work. Yes, they worked hard, but so did most of the bottom 95% who aren’t wealthy.

The deciding factor wasn’t the wealth they created as entrepreneurs or workers; it was the assets they were able to buy long ago as the direct result of financial help from their parents–or put another way, the wealth generated by the monumental inflation of assets their parents bought decades ago.

Scrape away the 1) parents-paid university, 2) the parental help in buying their first property, 3) their ability to save money in IRAs and 401Ks as a result of having low-cost mortgages (or no mortgage at all) and invest these savings in other assets at low prices, and 4) the rampant asset inflation of the past 30 years, and how much wealth would they own that was solely the result of their earnings / frugality?

Yes, there are wealthy entrepreneurs who earned their wealth by creating value in an enterprise, but once again, scrape away the enterprises that are bubble-dependent real estate and stock-market based ventures, and how many entrepreneurs actually created wealth via creating value? Take away the 30 years of asset inflation and the answer is very few.

Much of what the wealthy claim as brilliance is nothing more than the good fortune of living in a multi-decade era of ever-rising asset valuations.

Some friends inherited portfolios of dividend-paying stocks that had been on auto-reinvestment of dividends for 50 or 60 years. Small stakes invested back then are now worth $1 million or more. Others inherited gold purchased at low prices decades ago. These are just two examples of many transfers of wealth that rarely get mentioned.

As a general rule, the wealthy don’t reveal all the help they received, or attribute their wealth to asset inflation. They tout their long service in academia or Corporate America, their wise investing, their hard work, etc.

I know this because I’ve benefited from the same asset inflation, though I didn’t benefit from an inheritance or much help from my parents ( I did receive a rusting old VW that needed an engine rebuild–a real plus at the time as I needed a car to get to work). But even the accomplishments I can claim credit for–working my way through university by working 24-32 hours a week, fully self-supported, and building my own house at the age of 27–are out of reach of the majority of “normal people” now.

University tuition and fees have skyrocketed, and so have rents. It’s almost impossible for a young person to make enough income from 30 hours of work per week to pay all the university costs, the rent for a tiny studio ($135 per month in 1975) and maintain an old car, plus groceries, beer, etc.

There is one other factor that must be described in this stratification of wealth: the role of frugality. My wife and I lived in the cheapest, crummiest studio in the city for years, worked Saturdays on construction side-jobs, did our own auto maintenance, etc. to save up the money to buy a lot and building materials to build our own house. I know many other people, mostly immigrants but some native-born Americans, who followed the same route of extremely disciplined frugality to save up the down payment needed to buy a house.

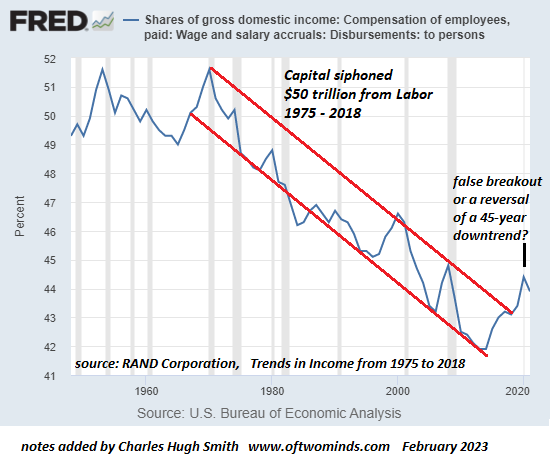

But even the path of frugality is steeper now. The rent for even the crummiest studio is sky-high, used cars cost a small fortune and wages have stagnated for 45 years, a fact I’ve often noted in my blog posts. Even wages in construction have stagnated.

Adjusted for inflation / purchasing power, I made more money as a 23-year old carpenter/tradecraft worker in 1976 than I’ve ever made since. In other words, it took fewer hours of work in 1976 to pay for basic shelter, food, utilities and transport than it does now. (See chart below of wages share of the economy: it topped in 1975.)

When the economic stratification was less pronounced and less entrenched, you might have had a spectrum of neighbors. Now the wealthy only know other wealthy people, because no one who isn’t wealthy can possibly buy a home in their exclusive enclaves or enter their social circles of people wealthy enough to donate to the arts or politics.

In the bubble of the wealthy, one hears about the travails of finding people to fix pool pumps, wealthy acquaintances who scored a beachfront rental for only $7,000 a month and endless stories of jetting around. One also hears strained efforts to show how frugal they are, as if scoring discounted airline flights is the sort of frugality that will eventually build up a down payment for an insanely over-valued house in their enclave.

Extreme stratification is now the norm globally. The barrier between those who inherited wealth or who had enough help to buy assets decades ago and those without parental wealth to help them now is impermeable. Even as younger generations lobby for more housing to be built, it’s still unaffordable unless it’s heavily subsidized.

Here are a few links describing aspects of this impermeable stratification:

New Grads Chasing ‘TikTok Lifestyles’ Struggle In NYC As Rents Surge

A Tale of Paradise, Parking Lots and My Mother’s Berkeley Backyard (NYT.com) NIMBYs and YIMBYs–older wealthier residents don’t want new multi-story housing to change their enclaves, younger people want more housing to (hopefully) lower rents.

Majority of flights taken by a small percentage of flyers

A bit of realism and humility are in order. Yes, we worked hard, but we’re not wealthy because we’re so brilliant or even because we’re so frugal. We’re wealthy because the global economy is structured to inflate asset bubbles. Those who bought or were given assets decades ago have benefited, those entering university and the workforce now cannot afford the same things we bought with average incomes without inheriting wealth from their families.

Those inside the bubble of wealth who only associate with other wealthy people don’t seem to notice the social / financial stratification or its profoundly negative consequences. Perhaps they think this is how everyone lives, fretting about finding cheap laborers and cheap flights, or they discount their own wealth as merely “comfortable.” Perhaps they think “since I’m doing great, everyone’s doing great.”

They have lost touch with those who didn’t get to buy assets on the cheap, who didn’t get their university education paid for by their family, who don’t have an inheritance or a down payment provided by the Bank of Mom and Dad.

History suggests such a stratified society cannot endure as a democracy.

This essay was drawn from my Weekly Musings Reports sent exclusively to

subscribers,

patrons and

Substack subscribers. Thank you very much for supporting my work.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

| Thank you, Wendell D. ($50), for your marvelously generous contribution to this site — I am greatly honored by your steadfast support and readership. |

Thank you, Judith G. ($50), for your magnificently generous contribution to this site — I am greatly honored by your steadfast support and readership. |